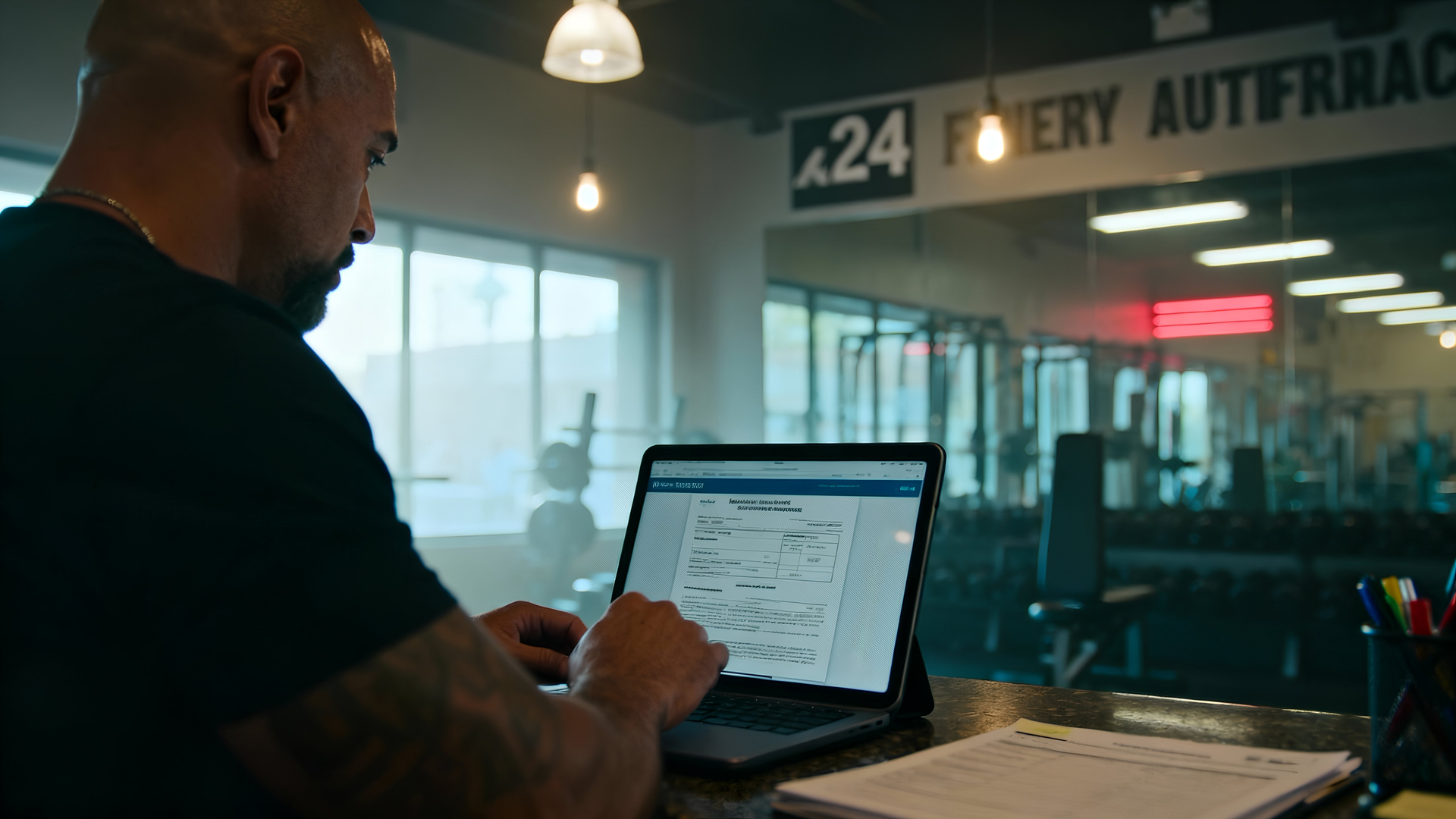

24/7 Gyms and Unstaffed Hours: The Insurance Risks Most Fitness Owners Underestimate

Why Around-the-Clock Access Changes Your Insurance Exposure More Than You Think

Twenty-four-hour access has become a competitive standard in the Australian fitness industry. Members expect flexibility, convenience, and access outside traditional staffed hours. For gym owners, 24/7 operation can drive membership growth without proportionally increasing staffing costs.

From an insurance perspective, however, unstaffed access fundamentally changes a gym’s risk profile.

Many fitness businesses move to 24/7 access without adjusting insurance arrangements, procedures, or disclosures. When incidents occur during unstaffed hours, gyms are often surprised by how closely insurers examine systems, controls, and governance — and how quickly assumptions unravel.

This article explains why 24/7 gyms require specialised insurance consideration, and how broker-led advice protects businesses operating beyond staffed hours.

Why Unstaffed Hours Are Viewed Differently by Insurers

Insurers do not assess risk purely on equipment or floor space. They assess control.

During staffed hours, control is exercised through:

- Supervision

- Immediate intervention

- Real-time incident response

- On-site enforcement of rules

During unstaffed hours, these controls are replaced by systems, and insurers scrutinise those systems closely.

Common insurer questions include:

- How is access granted and monitored?

- Who is allowed to train unstaffed?

- What safeguards exist for emergencies?

- How are incidents detected and reported?

Gyms that cannot clearly answer these questions may face restricted cover, higher premiums, or claim disputes.

Specialist gym insurance brokers anticipate these insurer concerns and help businesses structure defensible operating models.

Access Control Systems: Insurance Implications Beyond Security

Swipe cards, fobs, biometric access, and app-based entry systems are central to 24/7 gyms. From an insurance standpoint, these systems do more than control entry — they form part of the gym’s duty of care framework.

Insurers assess:

- Whether access logs are retained

- Whether access can be suspended remotely

- Whether unstaffed access rules are enforced

- Whether minors are appropriately restricted

If a serious incident occurs during unstaffed hours, access logs often become critical evidence. Incomplete or poorly managed systems can weaken a claim or raise governance concerns.

Brokers experienced in 24/7 gym operations advise clients on how access systems intersect with liability coverage — not just security.

Member Eligibility for Unstaffed Training

One of the most underestimated risks in 24/7 gyms is who is allowed to train alone.

Many gyms allow unrestricted access regardless of:

- Experience level

- Medical history

- Familiarity with equipment

- Completion of induction

From an insurance perspective, unrestricted access increases exposure — particularly if a member alleges they were inadequately prepared to train unsupervised.

Insurers may assess whether:

- Inductions were completed and documented

- Safety briefings were provided

- Equipment instructions were clearly displayed

- Restrictions applied to higher-risk activities

Gym insurance brokers help owners balance convenience with risk controls insurers recognise as reasonable.

Emergency Response During Unstaffed Hours

When staff are onsite, emergency response is immediate. During unstaffed hours, response relies entirely on systems and protocols.

Insurers commonly examine:

- Emergency buttons or alarm systems

- CCTV monitoring (live or recorded)

- Clear emergency signage and instructions

- Member education on emergency procedures

If an injury escalates due to delayed assistance, insurers may assess whether the gym took reasonable steps to mitigate foreseeable risk.

Brokers specialising in fitness insurance help gyms align emergency response systems with insurer expectations — particularly for overnight operations.

Equipment Use Without Supervision

Unstaffed hours do not change the equipment on the floor — but they do change how it is used.

Without supervision:

- Technique errors go uncorrected

- Risky behaviour is less likely to be challenged

- Equipment misuse may increase

If a claim involves equipment-related injury, insurers assess whether:

- Equipment was appropriate for unsupervised use

- Maintenance records were current

- Clear usage instructions were visible

Policies may still respond, but scrutiny increases significantly when incidents occur without staff present.

CCTV, Privacy, and Data Risk

Many 24/7 gyms rely heavily on CCTV for monitoring and post-incident review. While valuable, CCTV introduces additional insurance and compliance considerations.

From a risk perspective:

- Footage retention policies matter

- Privacy obligations apply

- Data breaches involving video footage can occur

Cyber and data-related exposures are increasingly relevant for gyms operating continuous surveillance systems.

Specialist brokers help gym owners identify when cyber insurance becomes relevant — even for businesses that do not consider themselves “tech-focused.”

Claims That Commonly Arise During Unstaffed Hours

Claims during unstaffed hours often involve:

- Solo training injuries

- Delayed discovery of incidents

- Allegations of inadequate safety controls

- Equipment misuse

These claims are rarely straightforward. Insurers closely examine operational decisions, including whether unstaffed access was appropriate for the individual involved.

Gyms with structured policies, documentation, and accurate disclosures experience far smoother claims outcomes than those relying on assumptions.

Why Disclosure Is Critical for 24/7 Operations

One of the most common insurance issues in 24/7 gyms is non-disclosure.

Some gyms:

- Extend hours gradually without notifying insurers

- Allow overnight access informally

- Add access features after policy inception

Insurers assess risk based on declared operations. If 24/7 access is not disclosed, claims arising during those hours may be challenged.

Gym insurance brokers ensure operating hours, access models, and supervision arrangements are accurately reflected in policy wording — reducing uncertainty at claim time.

Balancing Convenience With Insurability

Twenty-four-hour access is not inherently uninsurable. Many insurers support 24/7 gyms — when risk is clearly managed.

Broker-led advice helps gyms:

- Design access rules insurers accept

- Implement controls proportionate to risk

- Avoid unnecessary exclusions or premium spikes

The objective is not restriction, but structured freedom that protects both members and the business.

Insurance as Part of the 24/7 Business Model

For gyms operating around the clock, insurance is not a background requirement — it is part of the operating model.

Well-structured cover:

- Supports sustainable growth

- Protects against reputational damage

- Provides confidence to landlords and partners

- Reduces stress during incidents

Gyms that treat insurance as an afterthought often discover gaps only when claims arise.

Final Perspective

Unstaffed hours change everything — not just convenience.

Gyms that operate 24/7 without adjusting insurance expose themselves to unnecessary risk. Those that engage specialist gym insurance brokers early ensure their operating model is supported, defensible, and resilient.

Modern fitness businesses require modern risk strategies.

That is where broker expertise makes the difference.

Disclaimer

This content is general information only and does not constitute legal or insurance advice. Coverage requirements vary based on each business’s activities and risk profile, and policy terms and exclusions apply.

For fitness businesses seeking industry-specific guidance, gym insurance brokers provide advice and insurance solutions aligned with real-world fitness operations and unstaffed access risk exposure.

Does Your Business Need Specialised Insurance?

Fitness businesses operate differently from standard commercial operations. Gym insurance brokers specialise in fitness industry risk and help ensure insurance reflects real training activities, operating models, and exposure rather than generic assumptions.